Accounting & Audit

Why do I need accounting services? Why do I need accounting services?

Under the Hong Kong Inland Revenue Ordinance and accounting standards, companies are required to keep a complete and accurate record of their business accounts for at least seven years, and a neat and clear set of accounts is an important factor in the success of a business. If you want to save on the cost of hiring an experienced and tax-aware accountant, choosing our bookkeeping services is a good choice, not only can you save on the high salary and MPF expenses of an accountant, but you can also avoid the inconvenience of leaving your job at any time. Our professional accountants will keep your accounts in accordance with tax regulations and accounting standards, so that your accounts are legally clear and your operations are more efficient.

In order to prevent our clients from wasting their time in preparing wrong accounts which may lead to investigation or penalty by the Inland Revenue Department, we are committed to providing efficient monthly, quarterly and yearly computerised accounts management services and preparing financial statements on a regular basis to meet the various tax reporting requirements of our clients and the Inland Revenue Department.

Accounting scope classification.

Accounting Services.

Business analysis and assistance in setting up accounting systems

Invoice management, preparation and recording of accounting summons

The annual financial statements include a balance sheet, a cash account, a ledger, a receivable account and a payable account.

Income and Expenditure Account, Bank Reconciliation Statement, Cash Flow Chart

Tax Preparation Service

Timely and complete tax returns can save companies and individuals from being questioned and reclaimed by the Inland Revenue Department, while legal and personalised tax planning can reduce your annual tax burden.

Provision of tax return services.

- Employers' returns for staff salaries (BIR56A-F), property tax returns, individual tax returns and profits tax returns.

- Tax planning and various tax filing matters for limited companies, sole proprietorships, partnerships and individuals.

- Acting as the client's tax representative to respond to enquiries from the Inland Revenue Department, apply for objection to tax assessment or valuation, apply for provisional tax, apply for tax relief, apply for extension of time to file tax returns and handle tax investigations, etc.

What are the consequences of late tax returns?

Q: What are the consequences of late filing of tax returns?

If you or your business fails to submit your tax return by the specified deadline, you are in breach of the relevant Inland Revenue Ordinance. In serious cases, you may be prosecuted by the Inland Revenue Department and fined up to $10,000, plus a late payment charge (0.05% per day).

What should we do when we encounter a situation in the box ourselves?

Don't hesitate to ask us for advice through the following contacts.

Cheuk Yin Company WhatApp +852 9386 8391

Company phone +852 3482 6241

Ms. Lee +852 9301 1319

We have not had a single failure in over 10 years, so we can definitely help you and strive to be the first to deal with it and save money immediately. Recent successful cases are shared in practice.

Why do I need an audit?

Under current legislation, a company is required to engage a certified public accountant to audit its accounts. In Hong Kong, a certified public accountant's audit report is also a prerequisite for a limited company to file tax returns if it has a business. Under the Companies Ordinance, the annual financial statements of a limited company incorporated in Hong Kong are required to be audited by a certified public accountant who has been issued a practising certificate by the Hong Kong Institute of Certified Public Accountants ("HKICPA"). Apart from taxation, audit reports can also be used for financing and borrowing purposes and to improve the management of the business, thereby protecting the interests of shareholders.

Hong Kong Audit Requirements.

Under the law, companies incorporated in Hong Kong are required to have their financial statements audited annually by a CPA (Certified Public Accountant) registered in Hong Kong and an Auditor (Auditor), who is a third party independent of the company, to ensure that the audit report is fair and true. For listed companies, the auditor is required to perform an annual assessment of the company's financial statements in accordance with generally accepted accounting principles (GAAP) to ensure the accuracy of the company's financial position.

The financial statements of all companies or entities must comply with the audit requirements of the Companies Ordinance and Hong Kong Financial Reporting Standards. For companies listed in Hong Kong, they must comply with the relevant audit requirements under the Rules of the Stock Exchange of Hong Kong Limited. The audit does not necessarily have to be performed by an in-house position, and other companies or third parties may be appointed to perform the work on your behalf.

Audit scope classification:

- Audit of financial statements; accurate audit of company finances, business processes and

Internal controls.

- Internal control audits; primarily to establish a system of checks to ensure that the system of internal control safeguards

the security and integrity of assets and the correction of defects and the prevention of fraud and other illegal acts.

- Special purpose audits; e.g. planning and advising on initial public offerings (IPOs) or global capital raisings, and

Review of financial or profit forecasts, etc.

Financial statement audit/Audit and internal review/Audit report on special purpose engageme

Offshore company audit:

Whether an offshore company requires an audit depends on the jurisdiction in which the company is registered and the nature of the Hong Kong business in which the company is involved. If the company is registered in the British Virgin Islands, Seychelles, etc., as long as the company is not involved in business from Hong Kong, it will basically not receive a tax return from the Inland Revenue Department and will in effect not be required to submit an audit report.

The scope of our audit services includes:

Conducting statutory audits

Audit financial statements such as income statements and balance sheets

Assessing capital value

Annual review of the client's accounting and management systems

Assessing the legal compliance of a business

Establishment of reports and financial statements relating to mergers and acquisitions, acquisitions, litigation and pension funds

Development of economic responsibility and efficiency studies

If you fail to submit your annual tax return by the specified deadline, you may face a maximum fine10,000 of $, triple your tax liability for the year, compulsory cancellation of your company, compulsory deduction/freezing of bank accounts, blacklisting of directors for up to 6 months, etc....

|

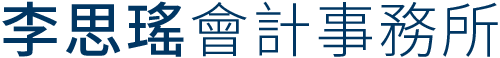

Client Case |

|

|

Time |

Penalties |

|

2020Day, 10month20 and year |

Second Payment Notice $2,400 |

|

2020Day, 11month3 and year |

Replacement First Payment Notice $1,200 |

|

2021Day, 6month28 and year |

Third Payment Notice $4,500 |

|

2021Day, 11month26 and year |

Receiving a court summons |